Imbalance on footprint chart and support of Rithmic Plug-in Mode. Time for a new update!

Навігація

We can't keep that from you anymore! Meet our new powerful Imbalance on footprint chart for order flow traders with multiple ratios, Stacked imbalances, Unfinished auctions and a bunch of awesome statistics. For avoiding additional fees for subscription to market data, we released support of Rithmic plug-in mode to control market data connectivity.

Imbalance Chart

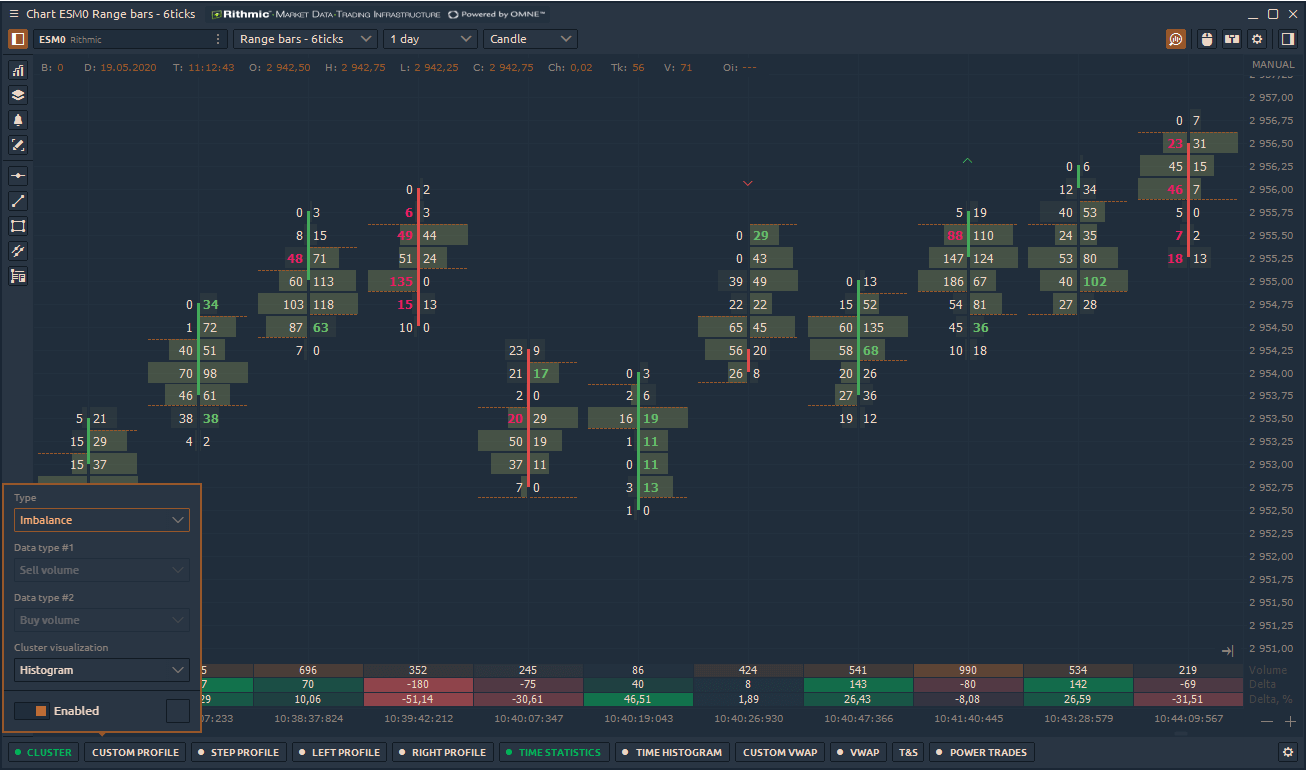

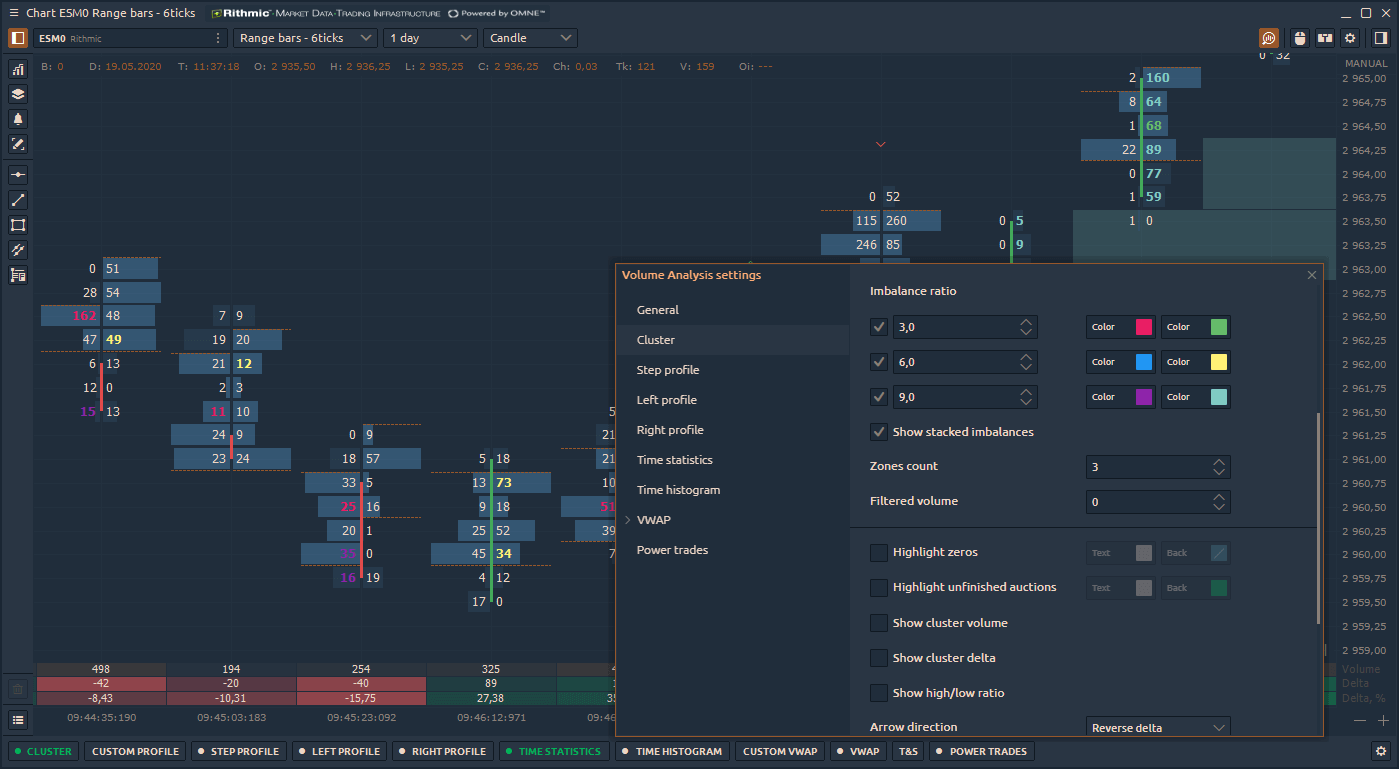

Cluster chart in Quantower platform allows you to see the traded volume at each price level and understands the intentions of traders regarding the future price. In the new version, we have changed the settings and added 3 types of cluster chart: Single, Double and Imbalance.

- Single cluster shows only one data type per each bar.

- Double cluster allows you to select two data types that will be shown in each bar. For example, you can select Volume for the first data type and Delta for the second data type.

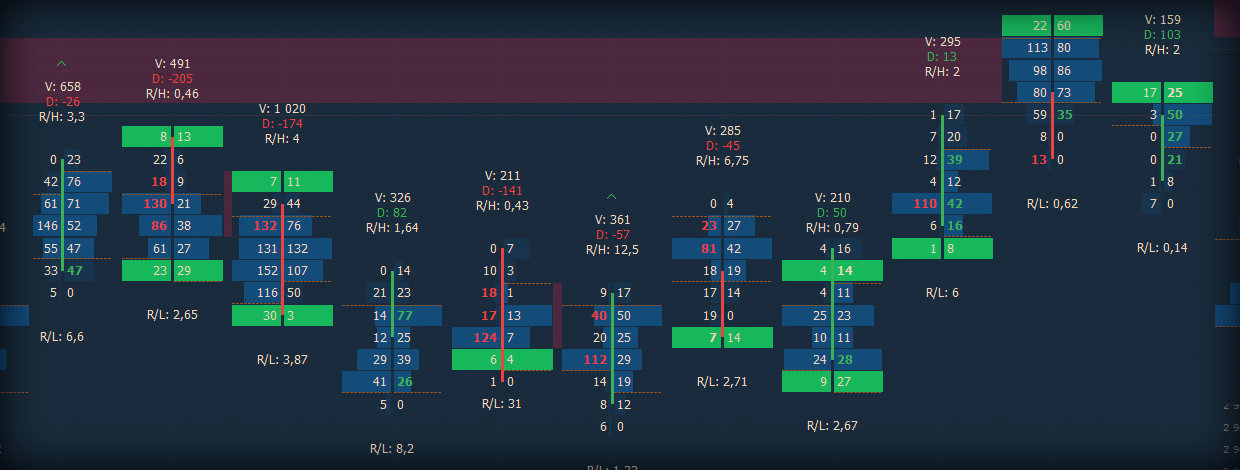

- Imbalance in footprint chart highlights the price levels where a buy trade volume is excess over a sell trade volume. Diagonal Bid/Ask imbalance displays aggressive buy market orders lifting the offer and aggressive sell market orders hitting the bid.

In the cluster chart settings, you can specify the ratio between buying and selling volumes diagonally at each price level. For example, Ratio = 3 will show on the chart all the imbalances, where the excess of buying over selling will be above 300%.

Additionally, you can set three different levels of imbalance and specify color settings for each of them.

Stacked Imbalances shows zones of multiple consecutive imbalances that occur on bid or ask side. These zones are important support/resistance levels because they are levels where participants aggressively wanted to get into the market. So when the market retests those levels, the same participants may appear again.

Unfinished auction is also known as unfinished business occurs at bar high/low prices where both buy and sell volumes were traded. The appearance of the unfinished auction indicates a possible continuation of the movement.

Added Rithmic Plug-in mode

Starting from May 1, the CME exchange сhanged the rules for determining a professional market participant, and as a result, increased the fee for the market data. In order to correctly define the professional participant, Rithmic has changed the connection parameters in their platform, as well as in API for platforms such as Quantower.

To avoid additional fees for subscription to market data, a trader needs to login through the R Trader Pro platform and activate the setting in Quantower, which is called Use RTrader.

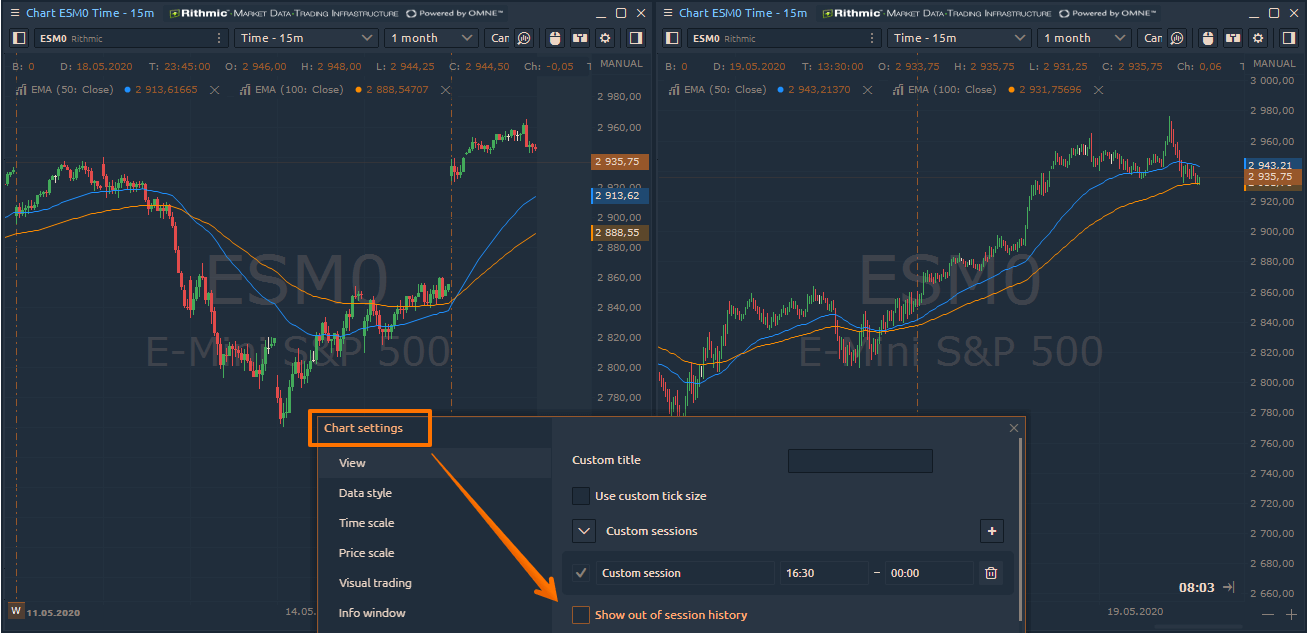

Hide Extended Hours data out of Custom Trade Session

In the previous release, we added Custom Session, which allows you to specify one or more active trading sessions on the chart. Now we have added the "Show out of session history" option, which shows or hides extended trading hours outside the set session on the chart. This option will be useful for stock traders, who are used to analyzing not only the main session but also pre- and after- hours.

DOM Trader improvements

Added a tooltip that shows the size of the order that trader is going to place. This will allow hiding the order entry sidebar, focus only on the trading process and always understand the order size that will be placed in the market.

Also, for Binance and Binance futures we have improved the Cancel Orders function, which will cancel all orders simultaneously (!). For those who actively trade cryptocurrencies and place a large number of orders, this option will speed up the cancellation of working orders.

Hope you enjoy the new Imbalance feature, and let us know what you think! Leave your questions and feedback and our team will be happy to help!

Коментарі