Meet dxFeed and CQG connections in Quantower! August updates digest

Навігація

Finally, we are happy to announce one of the most anticipated events in the development of our project. Meet a new trading connection — CQG via AMP Global broker.

Connection to CQG via AMP Global

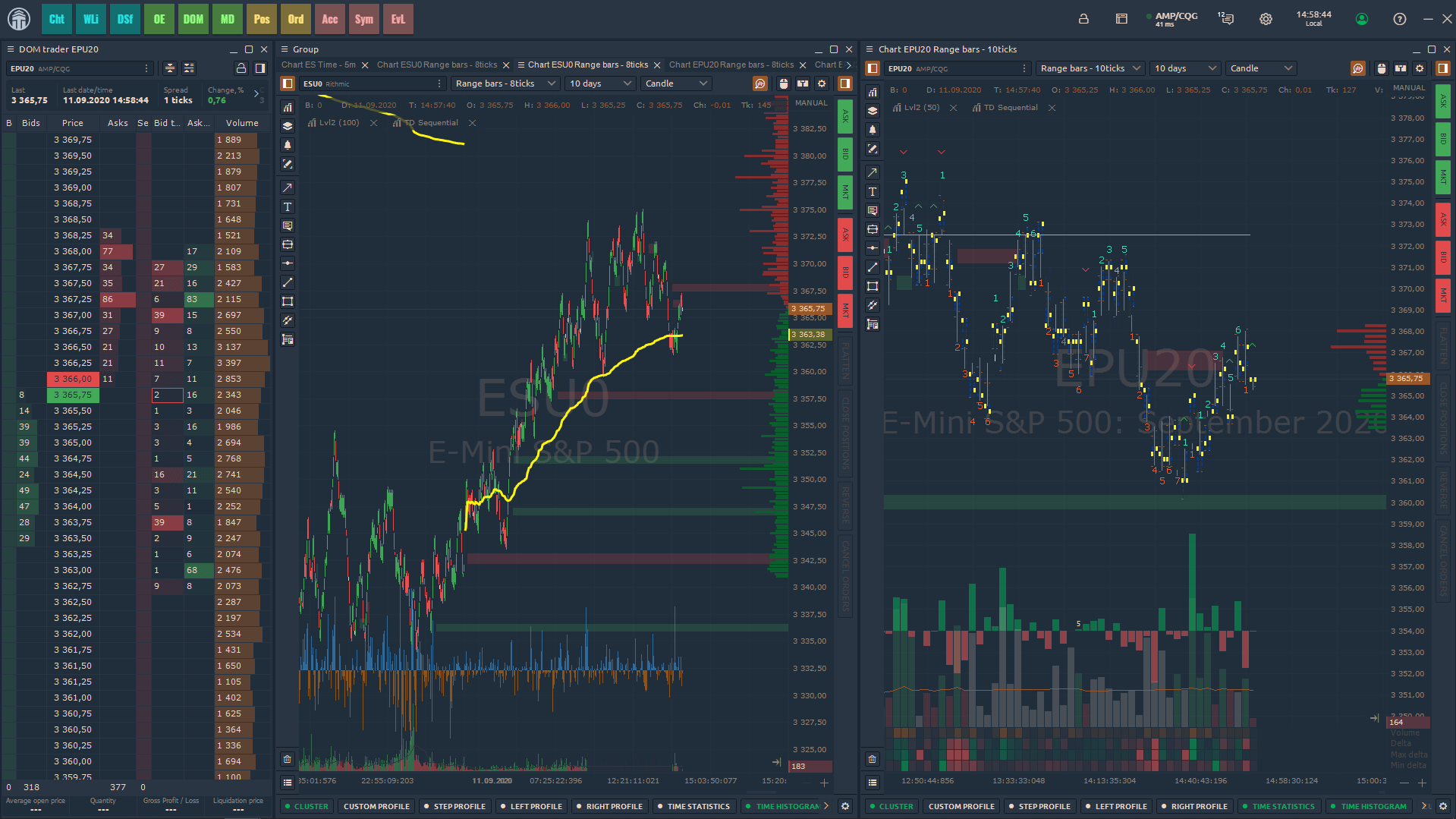

From now on all the users of the Quantower platform can trade with AMP Global broker that supports CQG technology. But that's not all! CQG usage opens access to more than 75 world exchanges, allowing you to trade futures, options, stocks, bonds, commodity spreads, and much more.

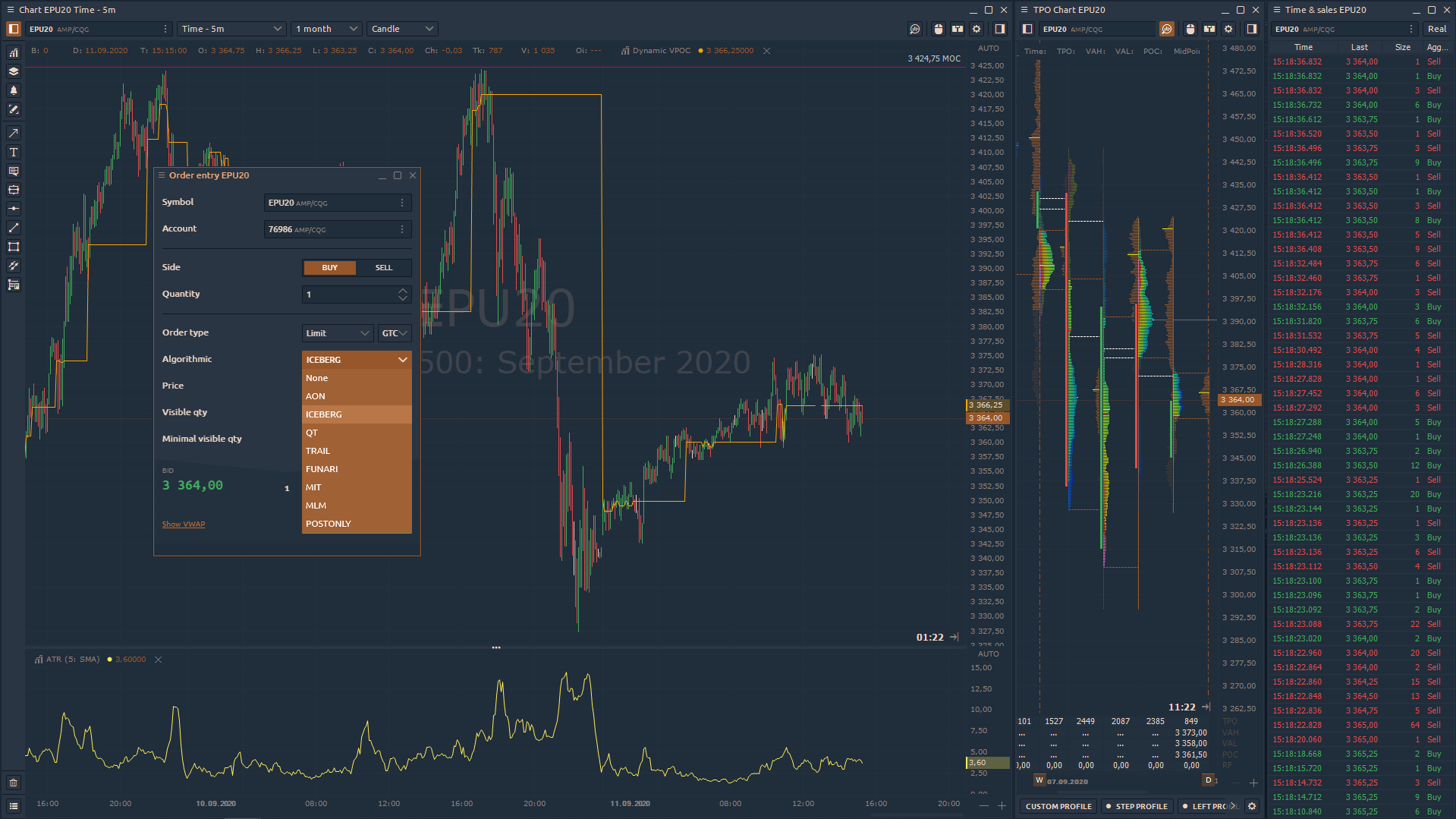

Besides, traders get the opportunity to work with a wide range of analytical tools, like volume profiles, footprint, VWAP, Power Trades, TPO chart, DOM Trader, Option Analytics and DOM Surface panels. In addition to the standard orders, Quantower has been added with algorithmic order types that reduces risks, speed performance time and ensures confidentiality for your transactions.

How to start trading via AMP/CQG connection?

By following this link you can register a demo account for 28 days and try all the functionality of the platform at work. If you already have a live trading account, you can start your trading directly via Quantower.

How to add trading symbols from the CQG connection?

By default, we do not provide a predefined list of symbols (maybe in the next updates we will add default symbols). To find the desired symbol, go to the Tradable Symbols page on the CQG site where you can find a correct ticker. Also, we’ve prepared a list of the most frequent trading symbols for the futures market.

| CME Globex | |

| E-mini S&P 500 Futures | EP |

| Micro E-mini S&P 500 Index Futures | MES |

| E-mini Nasdaq-100 Futures | ENQ |

| Micro E-mini Nasdaq-100 Index Futures | MNQ |

| E-mini Russell 2000 Index Futures | RTY |

| Euro FX Futures | EU6 |

| Micro EUR/USD Futures | M6E |

| British Pound Futures | BP6 |

| Australian Dollar Futures | DA6 |

| Canadian Dollar Futures | CA6 |

| Japanese Yen Futures | JY6 |

| New Zealand Dollar Futures | NE6 |

| Swiss Franc Futures | SF6 |

| CBOT | |

| E-mini Dow ($5) Futures | YM |

| Micro E-mini Dow Jones Futures | MYM |

| U.S. Treasury Bond Futures | USA |

| 2-Year T-Note Futures | TUA |

| 5-Year T-Note Futures | FVA |

| 10-Year T-Note Futures | TYA |

| Soybean Futures | ZSE |

| Wheat Futures | ZWA |

| Corn Futures | ZCE |

| NYMEX | |

| Crude Oil Futures | CLE |

| E-mini Crude Oil | NQM |

| Natural Gas Futures | NGE |

| Heating Oil | HOE |

| COMEX | |

| Gold Futures | GCE |

| Micro Gold Futures | MGC |

| Silver Futures | SIE |

| Copper Futures | CPE |

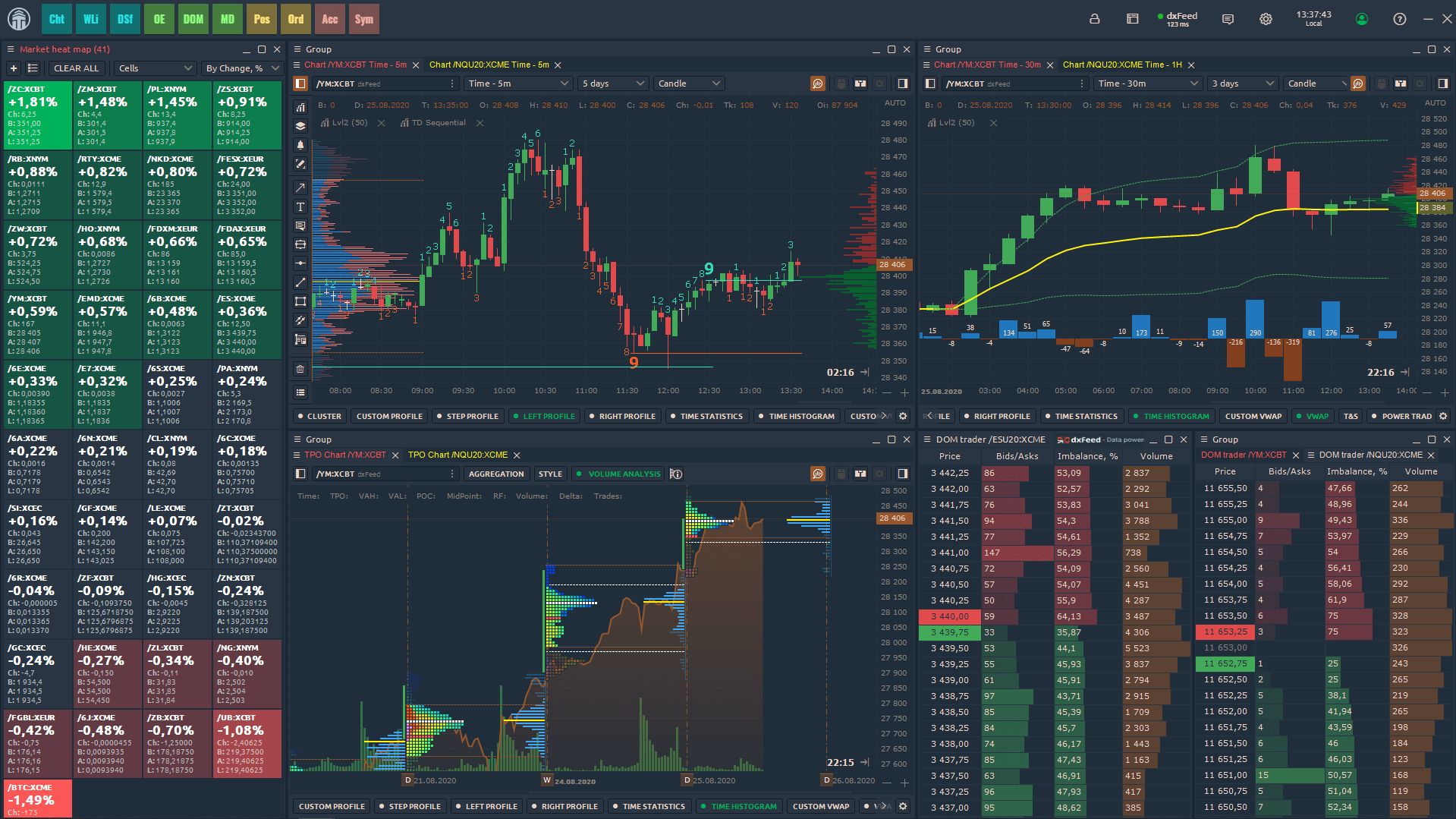

Connection to dxFeed data provider

We are happy to announce a successful integration with the dxFeed data feed — a leading provider of market data for trading and analytics. CME, CBOT, NYMEX, COMEX, EUREX Futures, U.S. Equities (Nasdaq) data is ready and waiting for you. Full list of available exchanges you can find on the official website of the provider. As we described in our previous article, dxFeed provides access to advanced platform functionalities.

What benefits does the dxFeed provider bring?

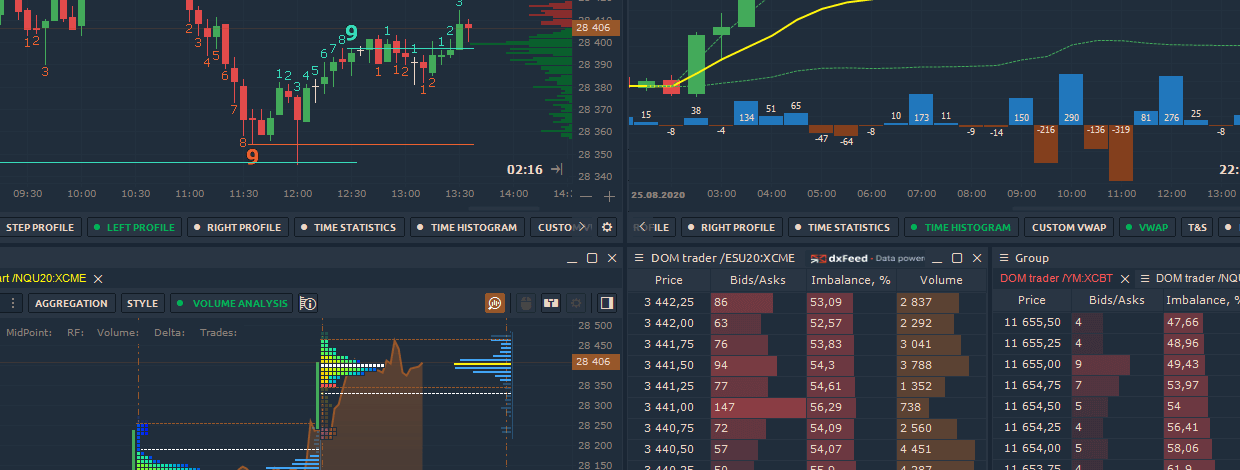

All Quantower users will have access to low-latency real-time data on futures, stocks, options. In addition to standard price data, dxFeed provides volume data for every trade, opening up the possibility to use volume analysis functionality in the platform — Volume Profiles, Time Statistics, VWAP, Cluster Chart with imbalances, and Power Trades tool.

All these professional features of Quantower platform and data from dxFeed will be indispensable for technical and orderflow analysis of futures, stocks, and other assets.

Коментарі