Axiory & Purple trading, abbreviative crypto prices & new indicators. New Quantower update.

Навігація

Following the previous release, we have integrated two more cTrader-related brokers into Quantower: Axiory & Purple trading. Along with this several usability features and useful indicators were added.

Axiory & Purple trading

Being powered by cTrader API 2.0 connection, Quantower now allows trading with two more brokers: “Axiory” and “Purple trading”. Both will become available in your Connections screen just after you get the latest update. Use your account credentials, provided by these brokers, to start trading and analysis with cTrader brokers in Quantower.

Abbreviative crypto prices

One of the great new features, that was developed based on a traders feedback — an abbreviation of crypto prices. This feature allows you to apply a special “shortening” for prices of Crypto-symbols only, resulting in “useless zeros” removal. The algorithm is simple — we just hide all “0” symbols from the left side of price and replace with “..”, for example, 0.0000145 -> ..145. This feature applies globally for all crypto-symbols in application thus changes price values in all panels.

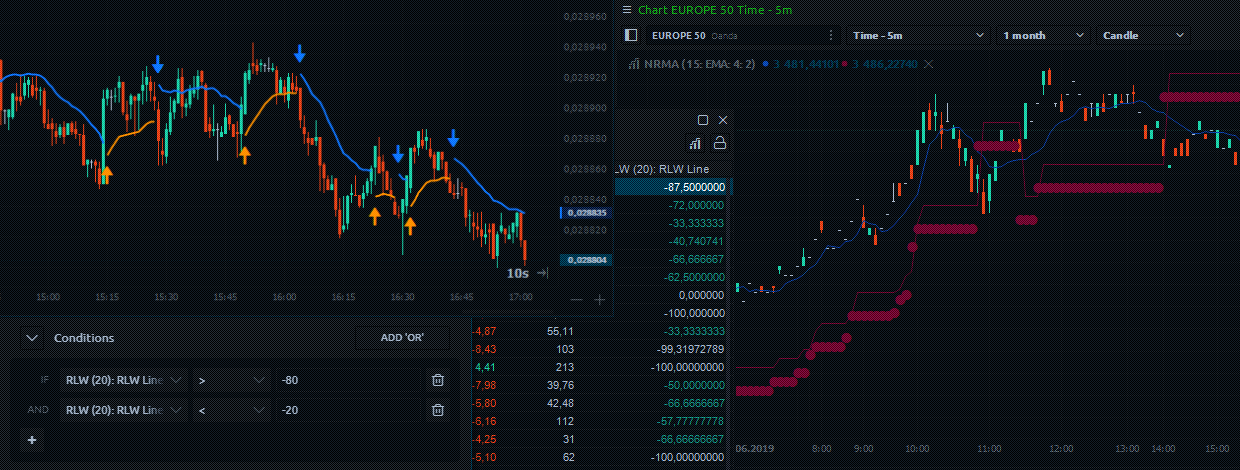

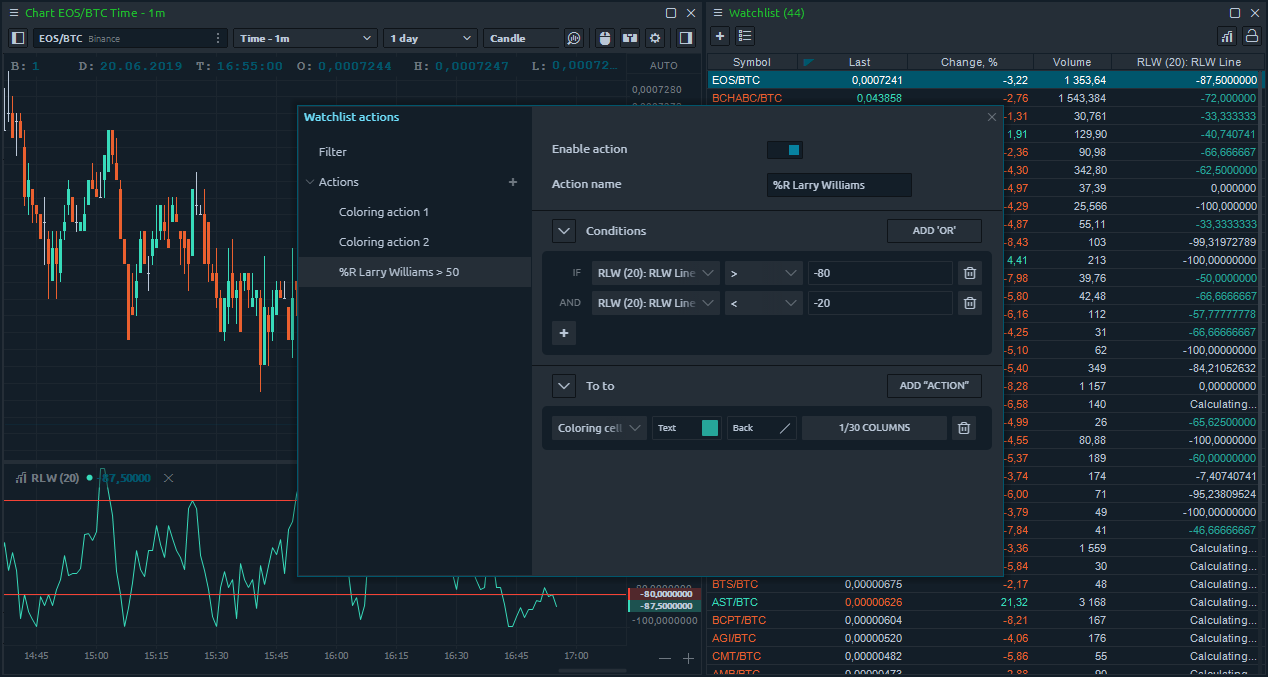

Indicators data in watchlist filters/alerts

Another great advice from our community lead us to develop a possibility to use calculated values of indicators in Watchlist filtering & alerts. Old Quantower traders already know about the possibility to add indicators in Watchlist and see their values in separate columns. Now you can use that values in Table actions functionality (Settings -> Setup actions) to filter rows of call an alert. This simple and yet powerful possibility is available starting from Free version of Quantower.

Omni trend indicator

The Omni Trend indicator (based on the NRTR indicator by Konstantin Kopyrkin) is a trend indicator that uses Average True Range & Moving Average to generate trading signals: buy — when price reaches the previous high & sell — when the price below the previous low.

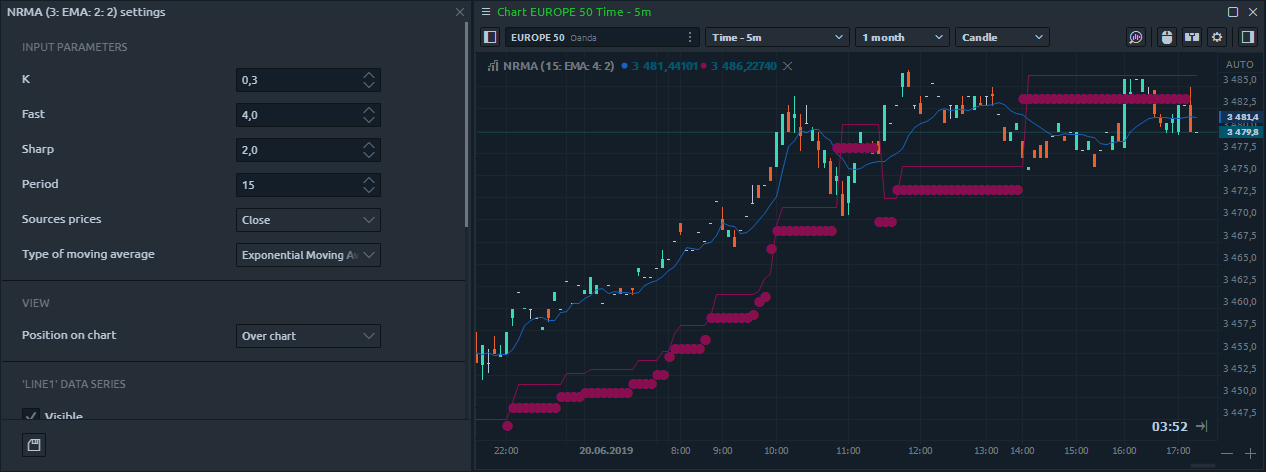

NRMA indicator

Another interesting indicator that might tell you when go long or short — NRMA indicator. It consists of dots, placed around the price, that suggest bearish (dots are above) or bullish (dots are below) price actions. You can find a lot of information on best practices for this indicator on the internet, but in short: buy when dots are below the price and sell when they are above.

Коментарі